Company Registration

About Private Limited Company

Registration of private limited company is common in India. Every time when we start a business, we think about the company registration in Gurgaon or Faridabad. Company formation in gurgaon or faridabad is an easy process, and it takes 7-10 days, provided all information and documents are complete. To register a private limited company, the minimum requirements are:

- Registered Office: Registered office of the company should be in India. You can call it, where all the notices and information from the government authorities are communicated.

- Minimum Directors: There should be at least 2 directors and 1 should be an Indian national and resident of India.

- Minimum Shareholders: 2 Shareholders are required. Directors can be a shareholder of the company.

A Private Limited company is a company held by founders privately in which no public money is allowed to invest in. A private limited company is a separate legal entity and its rights, obligations, assets and liabilities are separate from its members/shareholders. In India, Startups prefer to incorporate private limited companies because it is easy for them to receive money in the company and issue equity shares, preference shares and non-convertible debentures. Investor including Angel Investors and Venture Capitalists also prefer to invest in private limited companies. Hence incorporation of private limited companies for businesses like Startups becomes a necessity.

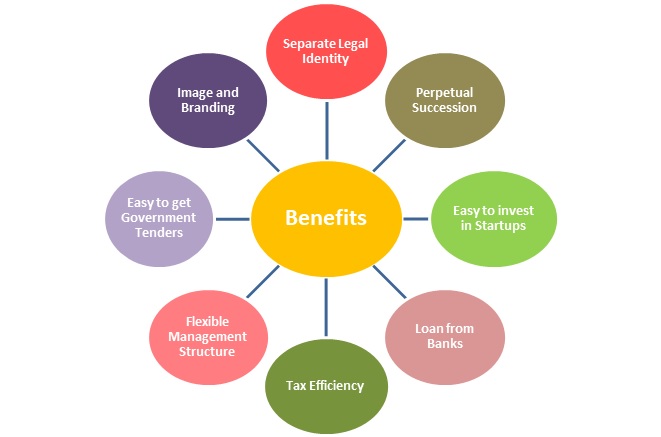

Benefits of Private Limited Company

These are a few illustrative lists of benefits. We have covered some of the key benefits for you:

- Separate legal identity: The liability of shareholders is limited and it is separate from the company, because the company has its own separate legal identity.

- Perpetual succession: The company has perpetual succession means that the death of any shareholder or director does not affect the existence of the company.

- Easy to invest in Startups: The startup can easily raise funds from investors in the private limited company. Even investors prefer to invest in a private limited company over LLP registration in gurgaon or faridabad and One person company.

- Loan from Banks: Company has its separate legal identity so it can raise funds from the banks and NBFC in its own name.

- Tax efficiency: The income tax rates are 15%/22%/25% for the private limited company as compared to LLP registration in gurgaon or faridabad and Partnership firms where the income tax rate is 30%.

- Flexible management structure: In a private limited company it is easy to appoint and resign a director/Management personnel from the company.

- Easy to get government tenders: Government tender’s primary requirement is that the applicant should be a private limited company. Mainly all tenders are allotted to private limited companies and registered LLP and Partnership firms are ignored in some tenders.

- Image and Branding: The name of the company is in itself a brand, however, you can give a brand name to your company which may be different from the name of the company.

Process of Private Limited company Registration

Below are the explanations for the above-mentioned process diagram:

Step-1: Name application is made with the registrar of company, where the application form for approval of the name is filed.

Step-2: After the approval of the name, digital signatures are applied for the subscriber of memorandum and articles. These digital signatures are used to sign incorporation forms.

Step-3: Under this step, all documents relating to incorporation are drafted and prepared.

Step-4: When all documents are ready, it should be filed with applicable forms as mentioned earlier.

Step-5: The registrar of company after reviewing the application, approves the application and issues the registration certificate.

Forms to be filed for Registration of Private Limited Company:

- Spice+ (Form-INC32): Simplified Proforma for Incorporating Company Electronically Plus is a web-based form, filed for registration of company

- MOA (Form-INC 33): Memorandum of association represents the charter of the company. It is a legal document, which is filed with the incorporation documents for company registration in Gurgaon or Faridabad. It also contains the subscribers and share capital details.

- AOA (Form No 34): It is referred to as Article of Association. It defines the rules and regulations of the company under which a company, directors, and shareholders must perform.

- Agile Pro (Form INC-35): This form is filed for an application for

- Goods and Service tax Identification number,

- employee state insurance corporation registration,

- employees provident fund organization registration,

- Profession tax registration,

- Opening of Bank account and Shops and Establishment Registration

- Form – INC-9: Declaration by Subscribers and first directors are filed using this form.

Checklist of documents for Registration of Private Limited Company

- Name of the company (subject to approval)

- Nature of Business of the company

- Objective of the company

- Proof of Registered Address:

- Copy of latest Utility Bill (Should not be more than 2 months)

- NOC from the property owner

- Notarized Rent Agreement (if office is rented)

- Copy of sale deed ( in case property is owned)

- Shareholders/ Promoters Details

- Name of Shareholders

- Number of shares subscribed

- Face Value per share

- Details of proposed director

- DIN of the director (if already allotted)

- Fathers Name

- Phone No and Email address

- Copy of Aadhar and PAN card

- Date of Birth

- Place of Birth

- Period of stay of director at present address

- Qualification

- Bank Statement (Three months)

- Proof of Permanent Address

- Proof of Current Address

Documents you get after incorporation

- DIN for 2 Directors

- Digital Signature for 2 subscribers

- Incorporation certificate

- Share certificates

- MOA+AOA

- Provident fund and ESI registration certificates

- PAN card of company

- TAN number of company

- Document support for opening Bank account

You can contact us at info@sksandassociates.com, if you are looking for a CA in Delhi, for company registration and formation in Delhi. Our team of experts will assist you in company incorporation and you will get satisfactory services from our professional experts.